Apply and get your Pan Card Online absolutely free in less than an hour in India.

Hii Dear Viewers! Welcome to my website.

Here in this post I will make you understand that how to Apply for Free Pan Card Online and How to Download Pan Card Online.

We all know that what actually Pan Card is. Pan Card in india is issued by Income Tax Department Of India to one who applies for it or to whom department allots number without an application. The full form of PAN is permanent identification number. Pan Card is a ten character Alphanumeric Number

In which first five characters are English Alphabets and sixth, seventh, eighth and ninth characters are numbers and tenth character is again an English alphabet below is given an example of PAN number.

ABCDE1234F

Who can apply for Pan Card.

Any Indian resident having the source of income with all necessary and valid documents can apply for Pan Card. For every tax payer and the person who needs to file an Income Tax return Pan Card is very necessary and mandatory.

Documents required for applying Pan Card.

In case of Individual below documents are required:-

POI/POA Proof of identification/ proof of address

Aadhaar Card

Passport

Driving Licence

Voter ID

If Hindu Undivided family is applying below document(s) are required

An affidavit of the HUF issued by the head of HUF along with POI/POA details

If Company registered under India firms partnership (LLP) is applying then documents required are:-

Certificate of Registration issued by Registrar of Companies

If trusts are applying the they need to provide below document(s):-

Copy of Trust Deed or a copy of the Certificate of Registration Number issued by a Charity Commissioner.

If Societies are applying below mentioned documents are required:-

Certificate of Registration Number from Registrar of Co-operative Society or Charity Commissioner

If Foreigners are willing to apply they need to provide these documents

Passport PIO/ OCI card issued by the Indian Government Bank statement of the residential country Copy of NRE bank statement in India.

What is E-Pan?

E-Pan is a degital format of Pan Card. It is a digitally signed pan card. It is issued in electronic format based on e-KYC data of adhar. E-Pan have same value like Physical pan card. You can also print out e-Pan Card from nearest Computer shop.

Documents required for e-Pan Card.

You need only Aadhaar card but that must be linked with your mobile number. Because in order to get free instant Pan Card you have to complete your e-KYC with Aadhaar OTP on Income Tax website.

If you haven't linked your number with your Aadhaar Card then please link it first and after that apply for free instant Pan card.

How to link mobile number with Aadhaar card

Visit your nearest Adhaar Update center along with your Aadhaar Card and Aadhaar update form with seal and sign of any officer mentioned on the form.

To locate your nearest update Center CLICK HERE

Minimum age to apply for Pan Card

Minimum age to apply for Pan Card is 18 years

The importance and uses of Pan Card.

IT returns filling:- A Pan Card is necessary for filling of IT returns. All individuals and entities who are eligible for Income tax are expected to file their IT returns.

To apply for credit card:- If you are willing to apply for a Credit Card you must have your own Pan Card. Pan Card is very necessary and mandatory in order to apply for credit card.

Purchasing or selling car/bike:- If you are buying or selling a car or bike worth more than 50,000 rupees you have to provide your Pan Card details to the bank.

Bank account opening:- If you are willing to open a savings account or current account in any bank wether it is private or govt. You need to submit your Pan card in order to open account with them.

Identity proof:- Pan Card can also be used as identity proof.

How to Apply for FREE Pan Card

There are only 4 steps to apply for a FREE e-Pan Card.

1 Enter Aadhaar number

2 OTP validation

3 Confirm Aadhaar details

4 Select and update pan details

I have explained all these steps below by following which you can apply for a free Pan Card online easily.

Firstly you have to visit the Official Website of Income Tax Department. CLICK HERE

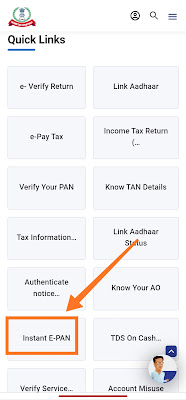

Now on the main page of the website you can see Instant E-Pan option click on that.

No you will be redirected to another page of the site. Now click on Get New e-PAN

Here 1 enter your Aadhaar number and 2 click on I CONFIRM THAT and then 3 click on Continue Button

Now you will recieve an OTP from Aadhaar on your registered number. Just enter that OTP in the otp input box and accept terms and conditions and click on continue button.

Now here your personal data based on your Adhaar e-KYC like name, DOB, address, photo will be displayed on the screen. Link your email by clicking on Link Email ID, and accept terms and conditions and then Click on continue button.

That is all you have successfully applied for a new pan card now your Application reference or acknowledgement number will be shown on the screen just copy that number, you will also receive that number on your registered mobile number.

Now wait for an hour, you will recieve an email and SMS also from income tax portal regarding your Pan allotment.

Now the another main question is How to download e-Pan Card?

Downloading of e-Pan Card comprises 3 steps.

1 Enter Aadhaar Number

2 Validate OTP

3 Download e-PAN PDF file

Below is the full procedure explained step by step....

Go to the main page of the website once again

Click on Instant E-PAN

Here click on Check status/ Download Pan Continue Button

Now enter your Aadhaar number and hit the Continue Button

Here now enter the OTP which your recieved on your registered mobile number and click on Continue Button

Now click on Download PDF file. After clicking on PDF a PDF file will be saved in your phone's storage.

That is it. You have now successfully made a Free pan card in less than an hour.

Now go to the file manager and open the PDF file and print out your card from nearest Computer shop.

Below is sample of e-Pan